Quitting the car industry to destroy it or to not face the competition?

Tesla officially announced the end of Model S and X. Those models were the foundation for the company. Their discontinuation is both a sign of retreat and new identity for Tesla.

Tesla officially announced the “honorable discharge” of the Model S and X. These vehicles laid the foundation for the company. Their discontinuation is both a sign of retreat and a radical reorganization of Tesla’s identity from car manufacturer to robotics powerhouse.

Burden of Aging Platforms

The Model S and Model X were aging architectures, respectively, with the platform released from 2012 to 2015. Despite iterative updates, these vehicles were designed with old manufacturing methods and powered with a 400-volt system.

Competitors moved to 800-volt architectures and simplified casting; the S and X became “legacy hardware” within Tesla’s own portfolio. The customers were aware and quite reluctant to spend $100k on aging models. The expected new brain AI5 (legacy HW4) is not even retrofittable to the most expensive vehicle in the catalog. Elon Musk describes AI5 as an “immense jump” in technology. While previous hardware updates from HW2 to 3 were incremental, AI5 is designed to handle the massive neural networks required for Unsupervised Full Self-Driving and the Optimus humanoid robot.

By 2025, sales of X and S accounted for less than 3% of total sales, yet they required significant factory floor space and a specialized, complex supply chain that weighed down the company’s margins.

Avoiding the EREV Trap, where industrials from China and South Korea lead the innovation

The global market has recently seen a massive surge in demand for Extended Range Electric Vehicles (EREVs), hybrids that use a small gas engine as a generator. While legacy automakers are pivoting back to these to satisfy range-anxious customers, Tesla refused to enter this “middle ground.”

By discontinuing the S and X rather than competing in the muddy waters of the EREV or large segments, Tesla preserves its image as a purely innovative, forward-looking firm. They aren’t “failing” at individual cars; they are simply exiting a maturing, lower-margin market to own the next one: AI.

Solving the self-driving car was the objective; now the excitement comes from outside the doors.

For Elon Musk, the challenge of the passenger car has largely been “solved.” With the mass-market success of the Model 3/Y and the stabilization of Full Self-Driving (FSD) software, the intellectual stimulation of perfecting the sedan has faded.

Both communication and engineering priorities have shifted to the Optimus humanoid robot. Musk has stated that once Tesla solved the self-driving challenge for cars, the logical next step was to apply that “real-world AI” to a humanoid form factor.

Tesla’s humanoid robot will be capable of operating a machine designed for humans. Therefore, we can foresee the Optimus 3 eventually driving any vehicle, making specialized, high-cost features in a car redundant. The robot itself is the “complex problem” Musk now wants to solve.

From Sales to “Transportation-as-a-Service” (TaaS), Tesla saves itself from competition and remains in an existing but profitable market

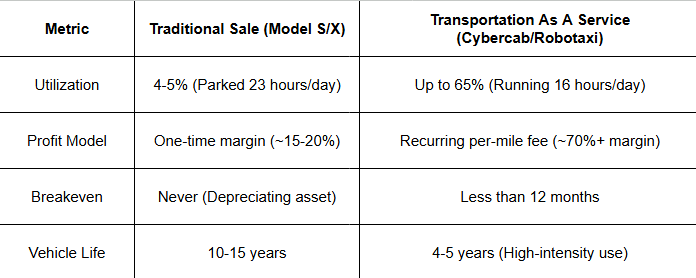

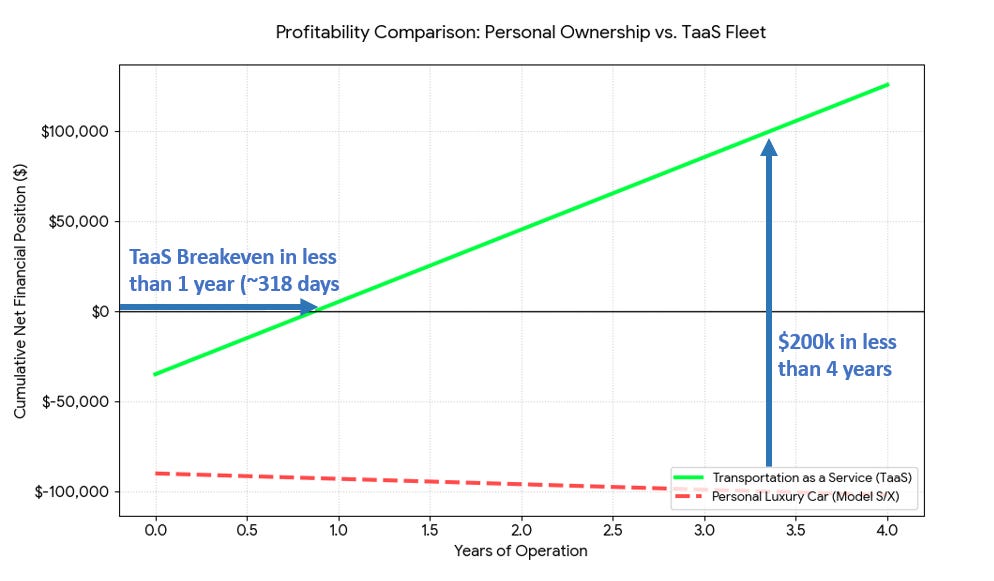

This is the most significant financial pivot in Tesla’s history. Building a car is expensive and yields a one-time profit margin. Selling a transportation service is a recurring revenue goldmine.

By transitioning to a fleet of autonomous taxis, Tesla aims to make a vehicle pay for itself within its first year of operation. The car is no longer a “product” to be pampered; it is a high-yield utility that works 16 hours a day, effectively turning the automotive business into a utility service.

Tesla can reinforce its status as an innovator by quitting a battle that was already lost. Quitting while still ahead is a strong marketing strategy. The timing is extremely well managed. The wave of enthusiasm around the latest Self-driving update, which has enabled significant progress in autonomy, is strong. While competition in EREV is not yet fierce, this is mainly due to trade constraints.

The future fleet is homogenizing around small and medium-sized vehicles (Cybercab and Model 2/3 variants) optimized for city navigation and high-density taxi service.

However, this transition leaves the future of the Supercharger network in flux. While the network is expanding to support the Tesla Semi with Megawatt charging, the “luxury” experience of the private owner is being replaced by the “utility” experience of the fleet operator.

Tesla made the EV market, creating an industry from scratch. A strong marketing leveraging the green appeal, and a robust high-tech offer. Now that the market becomes competitive, Tesla moves to its “comfort zone”, the area where nobody is comfortable... building a new market!

Think encore!

Thanks for writing this, it clarifies a lot. Your analysis perfectly articulates the strategic imperative behind Tesla's shift from automotive to a robotics and AI-centric identity, which is a fascinating, if brutal, market evolution. It's completely logical that aging platforms and the significant demands of AI5 for massive neural networks would render older models like the S and X obsolete, freeing up resources for future inovation.